Fighting fraud: recognising the most common tactics and protecting your business

Fraud is an ever-present problem in the business world and protection against it is crucial to maintaining the integrity of business. Recognizing common tactics used by fraudsters is the first step to protecting yourself. Some of the most common tactics include credit card theft, identity theft, account takeover…

Recognizing fraud early is key to limiting its impact. Merchants should be vigilant and look out for unusual buying patterns, discrepancies between billing and shipping addresses, repeated declined transactions, and suspicious customer behavior.

A variety of fraud detection tools are available, including credit card verification, identity verification, two-factor telephone authentication, and website behavior analysis. Security is also important – secure payment gateways, encryption of sensitive data and regular security audits are key. Proper management of transaction cancellations helps reduce financial losses and maintain customer trust.

With this awareness and the right tools, merchants can effectively protect their business from fraud and its adverse consequences. Fraud is not an insurmountable problem, but it does require constant attention and investment in security measures to keep your business safe and trustworthy.

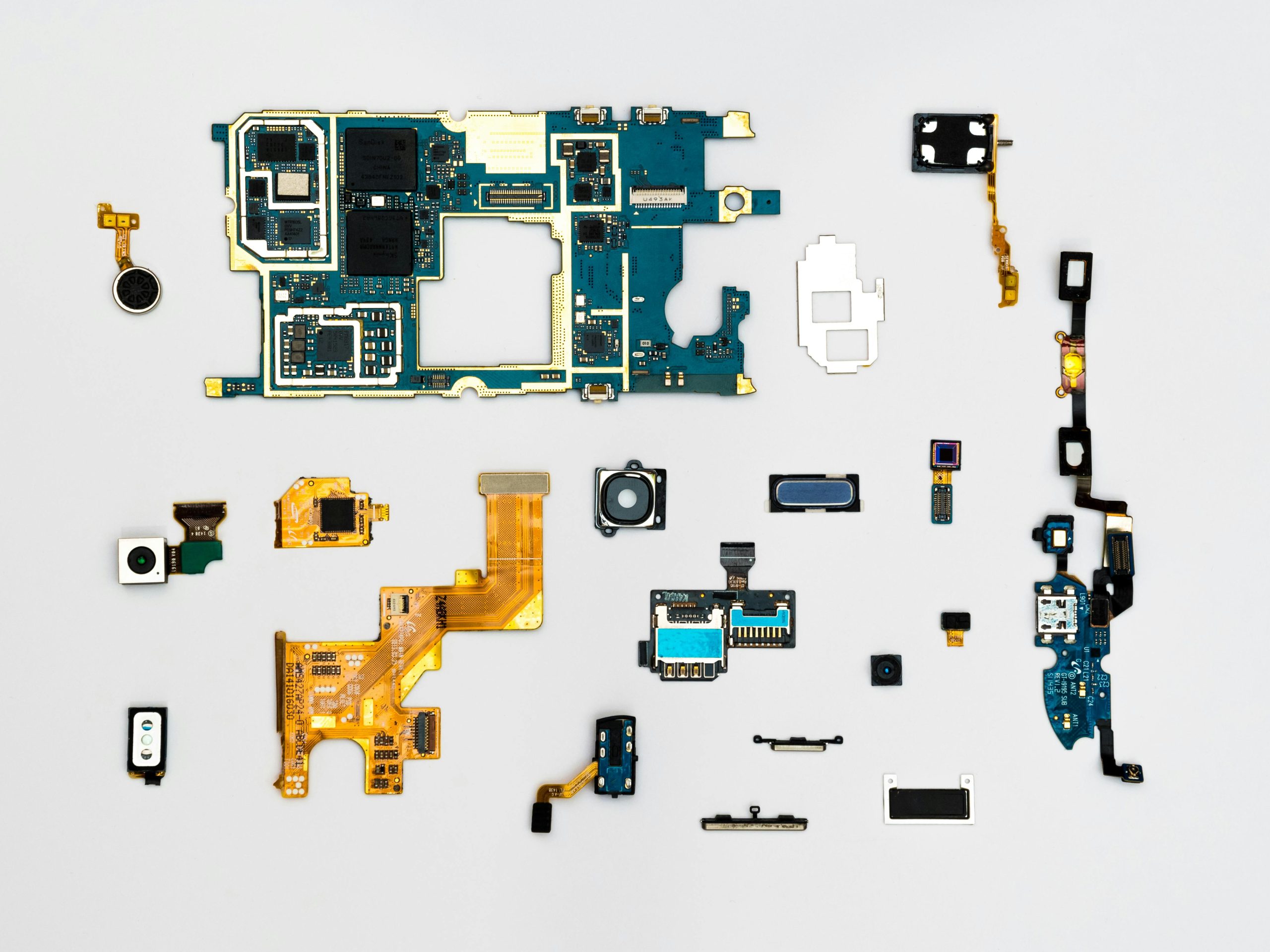

Photo source: www.pexels.com

Author of this article

WAS THIS ARTICLE HELPFUL?

Support us to keep up the good work and to provide you even better content. Your donations will be used to help students get access to quality content for free and pay our contributors’ salaries, who work hard to create this website content! Thank you for all your support!

OR CONTINUE READING