Revolutionizing the lottery industry: Allwyn’s remarkable growth and strategic acquisition of Camelot

In the third quarter of this year, the Allwyn betting company recorded a significant increase in its revenues, which doubled. Gross operating profit exceeded €1 billion after just nine months of the year, indicating that billionaire Karel Komarek’s firm is on course to surpass its results from last year. This success is partly attributed to the acquisition of Camelot, the UK operator of the National Lottery, which Allwyn bought in January this year.

In the third quarter, the European lottery leader’s revenues rose 98 percent year-on-year to €2.01 billion. Gross operating profit (EBITDA) rose 16 percent to 368.4 million euros. For the first nine months of this year, EBITDA was €1.1 billion, a significant increase on the year-ago period.

Allwyn also highlighted the importance of the Camelot acquisition, which has contributed significantly to the group’s overall success. Without the acquisition, revenues for the nine months would have risen by only seven per cent to €3.1 billion, compared to €5.7 billion in real terms. Allwyn’s management stressed that the business performance to date has been in line with expectations and that the business has been successful despite adverse consumer sentiment.

Strong inflation and high energy prices did not have a significant impact on Allwyn’s performance, and the company plans further expansion into new markets. Despite plans for a flotation on the New York Stock Exchange, which was postponed last year due to market volatility, interest in the move remains, although no concrete plans are yet on the horizon.

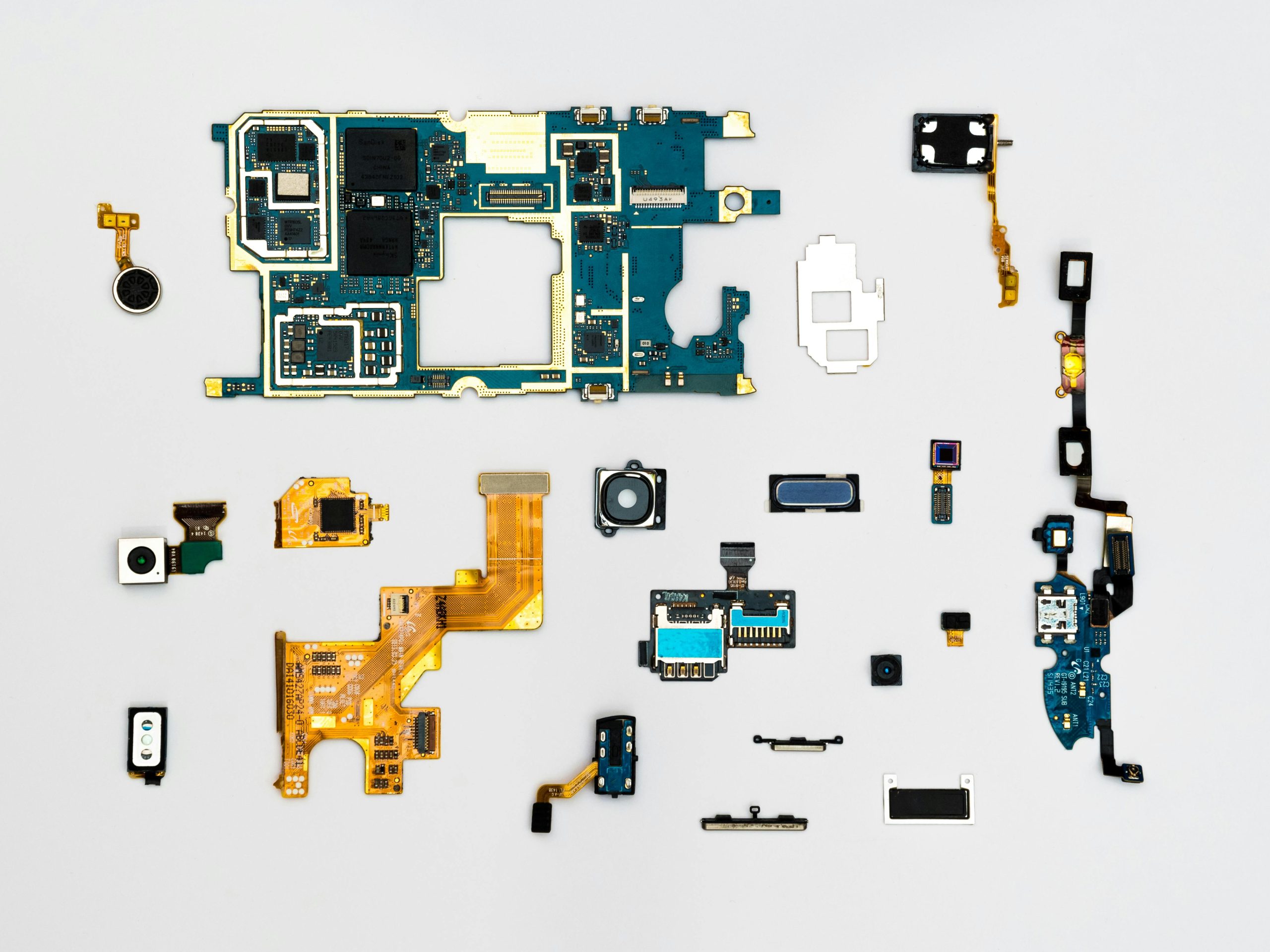

Photo source: www.pexels.com

Author of this article

WAS THIS ARTICLE HELPFUL?

Support us to keep up the good work and to provide you even better content. Your donations will be used to help students get access to quality content for free and pay our contributors’ salaries, who work hard to create this website content! Thank you for all your support!

OR CONTINUE READING