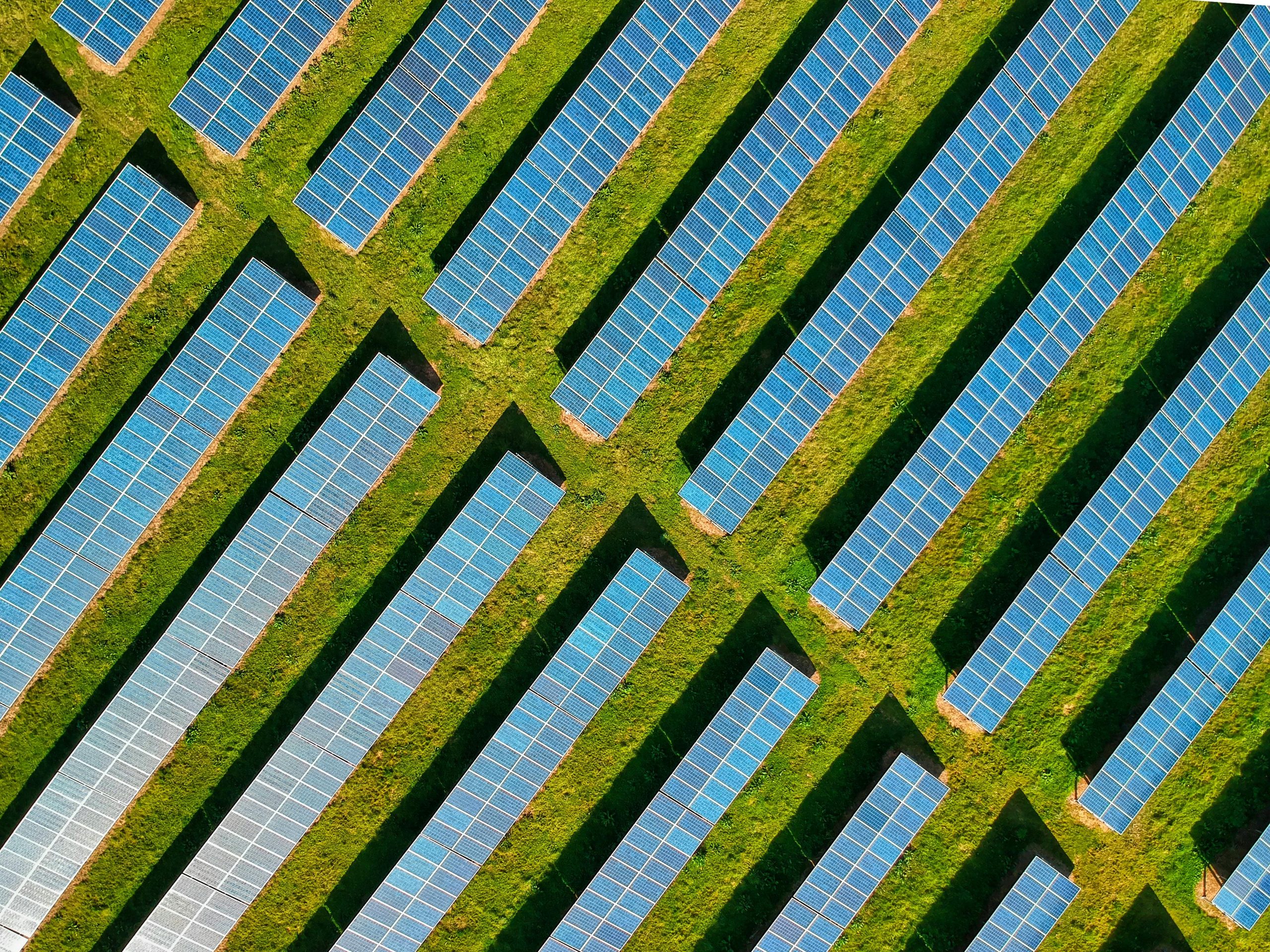

Czech Solar Developer Solek Declared Insolvent, Begins Court-Approved Reorganization Amid Billions in Debt

Solek Czech Services, a company specializing in the construction of solar power plants both in the Czech Republic and abroad, has been officially declared insolvent by the Municipal Court in Prague. However, the court also approved a reorganization plan, offering the company a chance to stabilize its operations and restructure its debt.

According to Hospodářské noviny, the firm’s total liabilities amount to approximately CZK 6 billion (around €240 million), with a significant portion owed to other entities within the Solek Holding group, as confirmed by data in the insolvency register.

The largest creditor outside the group is Konvertial SPV, a company linked to Czech defense entrepreneur Michal Strnad, which holds claims worth CZK 817 million. Thanks to its voting rights, Konvertial SPV played a key role in securing approval for a pre-arranged reorganization, an agreement between creditors and the debtor made before formal court proceedings. A representative from Konvertial SPV was also appointed to the creditors’ committee.

At the same time, Solek founder Zdeněk Sobotka stepped down from the company’s leadership and transferred his shares to attorney Jan Kotous and CFO Radim Baše, a restructuring expert with experience at Deloitte. In a statement, Sobotka explained that he made the decision due to a lack of confidence from creditors and other stakeholders in his ability to lead the reorganization process.

The approved reorganization plan aims to maintain the company’s operations, partially forgive some debts, and bring in a new investor—reportedly Alcor Investments, which has ties to the Strnad business network. The court also appointed Equity Solutions Appraisals to deliver a valuation report of Solek’s assets within two months.

The court scheduled the creditors’ review hearing and meeting for July 28, and confirmed the appointment of Dominik Hart as the insolvency administrator. Hart is known for his work in other high-profile insolvency cases, including the Arca group and the Tameh energy company.

In its insolvency petition, Solek attributed its financial difficulties primarily to regulatory changes in Chile, a key market for the group’s solar energy operations. Another contributing factor was the collapse of talks with a potential strategic partner, reportedly blocked by a foreign creditor who had funded Solek’s Latin American projects. Though unnamed in official filings, sources suggest the creditor is likely the American investment firm BlackRock.

Headquartered in Prague, the Solek Group focuses on renewable energy, especially solar power, and operates in several European and Latin American markets. The group consists of two main divisions:

-

Solek Services Holding, which oversees project construction, and

-

Solek IPP Holding, responsible for operating and managing completed solar plants.

Two years ago, Solek Services Holding reported an EBITDA of CZK 382 million on revenues of CZK 2.7 billion. Meanwhile, Solek IPP Holding posted revenues of CZK 207 million and EBITDA of CZK 84 million. Despite these numbers, the group’s total debt burden now exceeds CZK 8 billion, largely due to loans and bond issuances.

Photo source: www.pexels.com

Author of this article

WAS THIS ARTICLE HELPFUL?

Support us to keep up the good work and to provide you even better content. Your donations will be used to help students get access to quality content for free and pay our contributors’ salaries, who work hard to create this website content! Thank you for all your support!

OR CONTINUE READING