European Commission vs. cyber threat: the fight to protect bank accounts

Cyber fraudsters are increasing their attacks on bank accounts, resulting in loss of funds for their victims. The European Commission proposes that banks should be obliged to pay compensation in most cases where fraud is not detected in time.

However, this proposal is not in line with the wishes of the banks, which claim that the obligation to compensate unwary customers is illegal. According to Tomáš Hládek of the Czech Banking Association, this could be compared to the liability of a car manufacturer for an accident caused by a driver’s careless use of a vehicle.

The European Commission has put forward this proposal as part of the revision of the Payments Directive. It relates to situations where fraudsters contact the victim by telephone and disguise their number to make it look like a bank or police number. The proposal also covers situations where bank websites or emails are well faked. In the event of fraud, the defrauded person could claim full compensation if they report the case immediately to the police and the bank.

However, the theft of the money should not be due to gross negligence on the part of the customer, which means that it should not be obvious to them that it is a fraud. However, critics say this can be unclear, and the ongoing debate focuses on where client negligence begins and ends. Banks will also be able to put additional measures in place to warn customers of potential fraud. The discussion at the European Union level focuses on whether and when a customer may have had an inkling that they were not allowed to share sensitive account information.

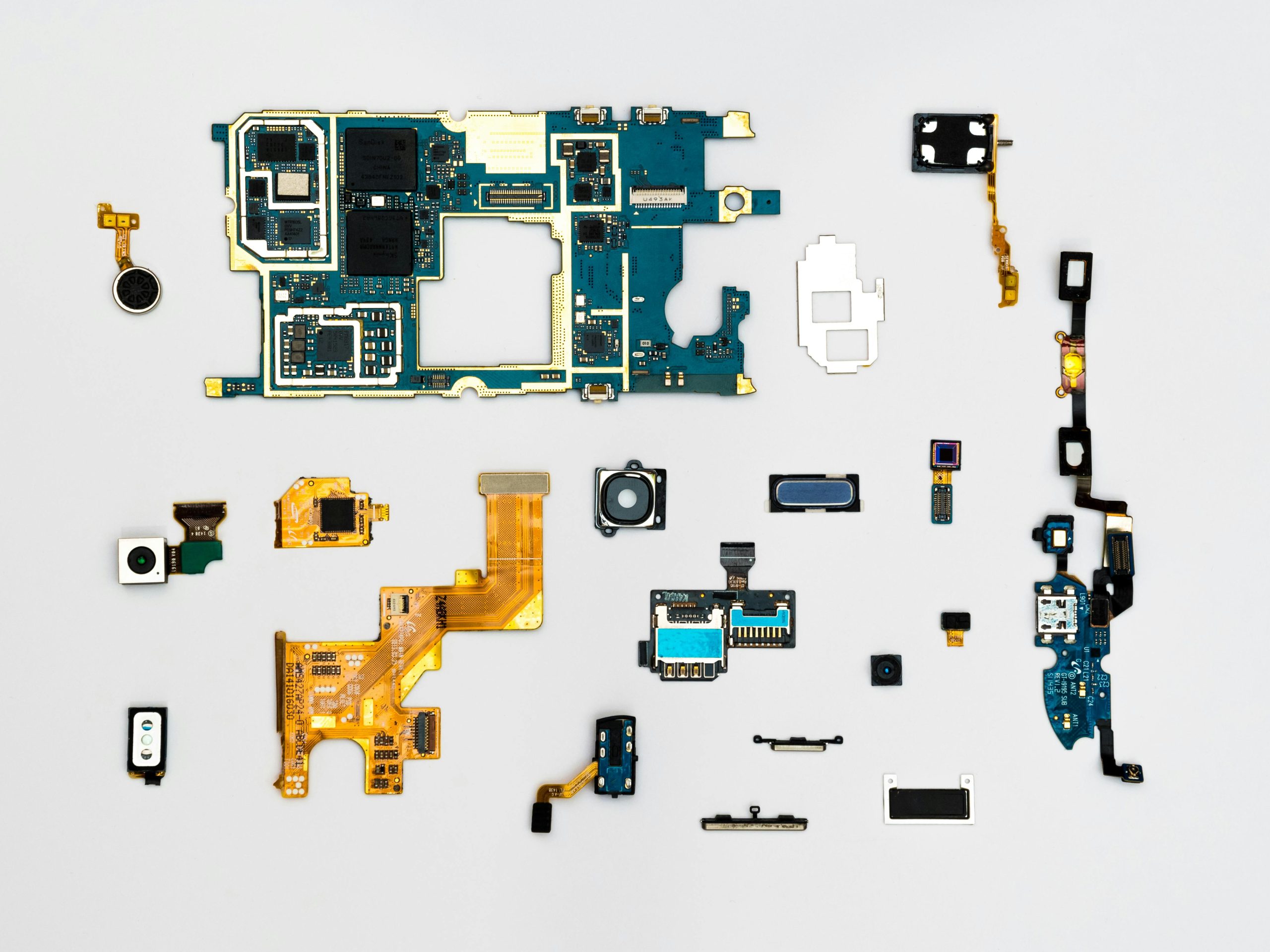

Photo source: www.pexels.com

Author of this article

WAS THIS ARTICLE HELPFUL?

Support us to keep up the good work and to provide you even better content. Your donations will be used to help students get access to quality content for free and pay our contributors’ salaries, who work hard to create this website content! Thank you for all your support!

OR CONTINUE READING